In the 20th century,

Detroit, Mich., symbolized American industrial might.

Today it symbolizes the offshored economy.

Detroit's population has declined by half. A quarter of

the city—35 square miles—is

desolate

with

only a few houses still standing on

largely abandoned streets. If the local government can

get the money from Washington, urban planners are going

to shrink the city and establish rural areas or green

zones where neighborhoods used to be.

President Obama and economists provide platitudes about

recovery. But how does an economy recover when its

economic leaders have spent more than a decade moving

high productivity, high value-added middle class jobs

offshore along with the Gross Domestic Product

associated with them?

Some very discouraging reports have been issued this

month from the Bureau of Labor Statistics. There have

been record declines in both jobs and hours worked. At

the end of last year, the U.S. economy had fewer jobs

than at the end of 1997, twelve years ago. Hours worked

at the end of last year were less than at the end of

1995, fourteen years ago.

The average workweek is falling and currently stands at

33.1 hours for non-supervisory workers.

In a major problem for economic theory, labor

productivity or output per man hour and labor

compensation have diverged markedly over the last

decade. Wages are not rising with productivity. Perhaps

the explanation lies in the productivity data. Susan

Houseman found that U.S. labor productivity statistics

might actually be reflecting the low wages paid to

offshored labor. An American company with production in

the U.S. and China, for example, produces aggregate

results in labor output and labor compensation. The

productivity statistics thus measure the labor

productivity of global corporations, not that of U.S.

labor.

Charles McMillion

has pointed out that unit labor costs actually fell

during 2009, but that non-labor costs have been rising

throughout the decade. The rise in non-labor costs

perhaps reflects the decline in the dollar's foreign

exchange value and the increased dependence on imported

factors of production.

Economists and policymakers tend to blame auto

management and unions for Detroit's fall. However,

American manufacturing has declined across the board.

Evergreen Solar recently announced that it is shifting

its production of solar fabrication and assembly from

Massachusetts to China.

A

U.S. Department of Commerce study

of the precision machine tool industry

has found that the U.S. comes in last.

The U.S. industry has a shrinking market share and the

smallest increase in export value. The Commerce

Department surveyed American end-users of precision

machine tools and found that imports accounted for 70

percent of purchases. Some U.S. distributors of

precision machine tools do not even carry U.S. brands.

The financial economy which was to replace the

industrial economy is nowhere in sight. The U.S. has

only five banks in the world's top 50 by size of assets.

The largest U.S. bank, JPMorgan Chase ranks seventh.

Germany has seven banks in the top 50, and the United

Kingdom and France each have six. Japan and China each

have five banks in the top 50, and together the small

countries of Switzerland and the Netherlands have six

with combined assets $1.185 trillion more than the five

largest U.S. banks.

Moreover, after the

derivative fraud

perpetrated on the world's banks by the U.S. investment

banks, there is no prospect of any country trusting

American financial leadership.

The American economic and political leadership has used

its power to serve its own interests at the expense of

the American people and their economic prospects. By

enriching themselves in the short-run,

banksters and politicians

have driven the

U.S. economy into the ground. The U.S. is on a path to

becoming

a Third World economy.

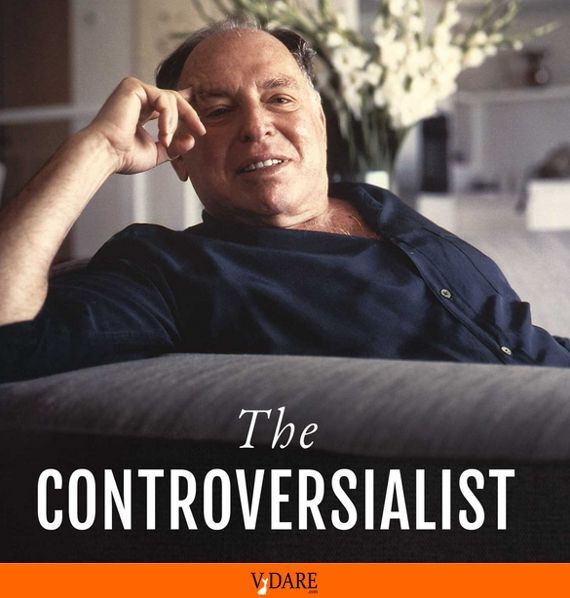

Paul Craig Roberts [email

him] was Assistant

Secretary of the Treasury during President Reagan's

first term. He was Associate Editor of the Wall

Street Journal. He has held numerous academic

appointments, including the William E. Simon Chair,

Center for Strategic and International Studies,

Georgetown University, and Senior Research Fellow,

Hoover Institution, Stanford University. He was awarded

the Legion of Honor by French President Francois

Mitterrand. He is the author of

Supply-Side Revolution : An Insider's Account of

Policymaking in Washington;

Alienation

and the Soviet Economy and

Meltdown: Inside the Soviet Economy,

and is the co-author

with Lawrence M. Stratton of

The Tyranny of Good Intentions : How Prosecutors and

Bureaucrats Are Trampling the Constitution in the Name

of Justice. Click

here for Peter

Brimelow's Forbes Magazine interview with Roberts

about the epidemic of prosecutorial misconduct.

His latest book, How The Economy Was Lost![]() ,

has just been published by CounterPunch/AK Press.

,

has just been published by CounterPunch/AK Press.